All Categories

Featured

Table of Contents

Only the passion portion of each payment is taken into consideration taxed revenue. With a postponed annuity, you make normal premium payments to an insurance policy business over a period of time and allow the funds to develop and earn rate of interest during the buildup stage.

This suggests an annuity may aid you accumulate a lot more over the lengthy term than a taxable financial investment. Any type of profits are not taxed up until they are taken out, at which time they are taken into consideration average revenue. A variable annuity is an agreement that offers changing (variable) instead of fixed returns. The crucial attribute of a variable annuity is that you can regulate how your costs are invested by the insurer.

Many variable annuity agreements provide a range of properly managed portfolios called subaccounts (or financial investment options) that invest in stocks, bonds, and money market instruments, along with balanced financial investments. Some of your payments can be put in an account that uses a fixed rate of return. Your premiums will certainly be alloted among the subaccounts that you choose.

These subaccounts vary in value with market conditions, and the principal may be worth essentially than the original cost when given up. Variable annuities offer the twin benefits of investment flexibility and the capacity for tax deferral. The taxes on all interest, returns, and funding gains are deferred till withdrawals are made.

Analyzing Strategic Retirement Planning A Closer Look at Fixed Index Annuity Vs Variable Annuities Breaking Down the Basics of Retirement Income Fixed Vs Variable Annuity Advantages and Disadvantages of Different Retirement Plans Why What Is A Variable Annuity Vs A Fixed Annuity Can Impact Your Future Variable Annuity Vs Fixed Annuity: Explained in Detail Key Differences Between Fixed Vs Variable Annuities Understanding the Risks of Variable Vs Fixed Annuities Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to What Is Variable Annuity Vs Fixed Annuity A Closer Look at Fixed Interest Annuity Vs Variable Investment Annuity

The program, which has this and other details about the variable annuity contract and the underlying financial investment options, can be acquired from your financial professional. Make sure to check out the syllabus thoroughly before choosing whether to invest. The details in this newsletter is not meant as tax, legal, financial investment, or retired life advice or referrals, and it may not be relied on for the objective of preventing any type of federal tax penalties.

2025 Broadridge Financial Solutions, Inc.

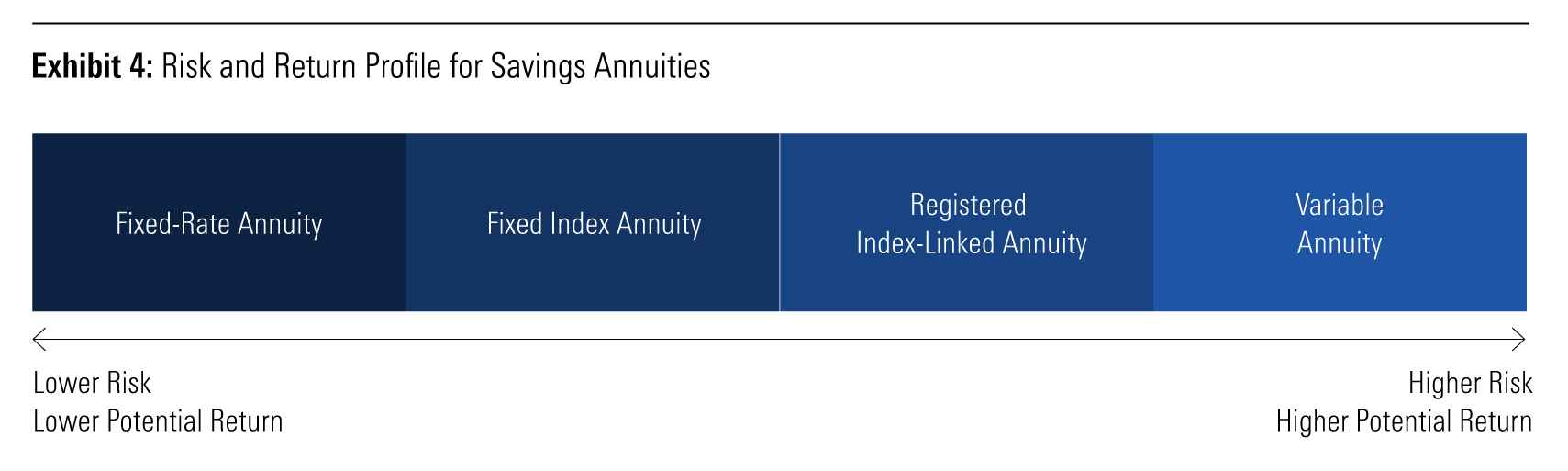

2 of the most usual alternatives include dealt with and variable annuities. The primary difference between a dealt with and a variable annuity is that repaired annuities have an established price and aren't tied to market performance, whereas with variable annuities, your ultimate payment depends on just how your chosen investments execute.

You can select just how much money you want to add to the annuity and when you wish to start receiving income repayments. Typically speaking, repaired annuities are a predictable, low-risk method to supplement your earnings stream. You can money your repaired annuity with one swelling sum, or a collection of repayments.

You can money a dealt with or variable annuity with either a lump sum, or in installations over time. Most of the time, variable annuities have longer accumulation durations than dealt with annuities.

Breaking Down Your Investment Choices Everything You Need to Know About Annuities Fixed Vs Variable Breaking Down the Basics of What Is Variable Annuity Vs Fixed Annuity Advantages and Disadvantages of What Is Variable Annuity Vs Fixed Annuity Why Choosing the Right Financial Strategy Is Worth Considering Annuity Fixed Vs Variable: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Fixed Vs Variable Annuities? Tips for Choosing Fixed Vs Variable Annuities FAQs About Indexed Annuity Vs Fixed Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to What Is Variable Annuity Vs Fixed Annuity A Closer Look at Fixed Indexed Annuity Vs Market-variable Annuity

Both fixed and variable annuities offer you the possibility to go into the annuitization stage, which is when you obtain cash from your annuity. With repaired annuities, you'll receive revenue in repaired installations that are guaranteed to remain the same. You'll pick when you intend to begin receiving settlements. With variable annuities, the payments you receive will certainly be affected by the efficiency of your underlying investments.

This could be one decade, twenty years, or for life. The surrender period is the time structure during which you can not take out funds from your annuity without paying extra fees. Surrender durations generally relate to just deferred annuities so they can relate to both taken care of delayed annuities and variable annuities.

Living benefits impact the revenue you receive while you're still active. For instance, you might intend to include an ensured minimum build-up value (GMAB) cyclist to a variable annuity to ensure you won't shed cash if your investments underperform. Or, you may want to add a price of living modification (SODA) motorcyclist to a dealt with annuity to help your settlement quantity stay up to date with inflation.

If you want to start receiving revenue settlements within the next year, a prompt fixed annuity would likely make even more feeling for you than a variable annuity. You can take into consideration a variable annuity if you have more of a tolerance for danger, and you want to be more hands-on with your investment option.

Among these distinctions is that a variable annuity may give payment for a lifetime while mutual funds may be depleted by withdrawals on the account. Another essential distinction is that variable annuities have insurance-related expenses and shared funds do not. With every one of the major and small distinctions in dealt with annuities, variable annuities, and mutual funds, it is necessary to consult with your financial advisor to ensure that you are making wise money decisions.

In a taken care of annuity, the insurance policy business guarantees the principal and a minimum interest rate. To put it simply, as long as the insurance provider is financially sound, the cash you have in a fixed annuity will certainly expand and will not go down in worth. The development of the annuity's worth and/or the benefits paid may be fixed at a dollar quantity or by a rates of interest, or they might grow by a defined formula.

Highlighting Pros And Cons Of Fixed Annuity And Variable Annuity Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Key Features of Choosing Between Fixed Annuity And Variable Annuity Who Should Consider Annuity Fixed Vs Variable? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Indexed Annuity Vs Fixed Annuity A Closer Look at Annuities Variable Vs Fixed

Most variable annuities are structured to provide investors numerous various fund choices. An equity-indexed annuity is a type of repaired annuity, however looks like a crossbreed.

This withdrawal flexibility is attained by changing the annuity's worth, up or down, to reflect the adjustment in the rates of interest "market" (that is, the basic level of rate of interest) from the start of the chosen period to the moment of withdrawal. All of the following sorts of annuities are offered in dealt with or variable forms.

The payout could be a very lengthy time; delayed annuities for retired life can stay in the deferred stage for years. An instant annuity is designed to pay an income one time-period after the immediate annuity is acquired. The time period relies on how usually the revenue is to be paid.

Understanding Fixed Interest Annuity Vs Variable Investment Annuity Everything You Need to Know About Financial Strategies What Is Fixed Annuity Vs Equity-linked Variable Annuity? Benefits of Choosing the Right Financial Plan Why Annuity Fixed Vs Variable Can Impact Your Future Annuity Fixed Vs Variable: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Rewards of Variable Annuity Vs Fixed Indexed Annuity Who Should Consider Annuity Fixed Vs Variable? Tips for Choosing the Best Investment Strategy FAQs About Fixed Interest Annuity Vs Variable Investment Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to What Is A Variable Annuity Vs A Fixed Annuity A Closer Look at Annuities Fixed Vs Variable

A fixed period annuity pays an income for a given time period, such as ten years. The quantity that is paid does not depend upon the age (or proceeded life) of the person who buys the annuity; the settlements depend instead on the quantity paid right into the annuity, the length of the payout duration, and (if it's a fixed annuity) a rate of interest that the insurance provider thinks it can support for the size of the pay-out duration.

A variation of lifetime annuities proceeds revenue until the second a couple of annuitants dies. No various other kind of financial item can assure to do this. The amount that is paid depends upon the age of the annuitant (or ages, if it's a two-life annuity), the amount paid right into the annuity, and (if it's a set annuity) a passion rate that the insurer believes it can sustain for the size of the anticipated pay-out duration.

Several annuity purchasers are awkward at this possibility, so they add an assured periodessentially a set duration annuityto their lifetime annuity. With this combination, if you pass away before the fixed duration ends, the revenue remains to your beneficiaries up until completion of that duration. A certified annuity is one used to spend and disburse money in a tax-favored retired life strategy, such as an individual retirement account or Keogh plan or strategies governed by Internal Revenue Code sections, 401(k), 403(b), or 457.

Table of Contents

Latest Posts

Breaking Down What Is Variable Annuity Vs Fixed Annuity A Comprehensive Guide to Investment Choices Breaking Down the Basics of Fixed Income Annuity Vs Variable Growth Annuity Features of Fixed Vs Var

Decoding How Investment Plans Work Key Insights on What Is A Variable Annuity Vs A Fixed Annuity What Is the Best Retirement Option? Benefits of Fixed Income Annuity Vs Variable Annuity Why Choosing t

Exploring the Basics of Retirement Options A Comprehensive Guide to Fixed Vs Variable Annuity Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Variable Annuity V

More

Latest Posts